Merchants today have an array of options to choose from when it comes to a payment processor, with 29,955 Fintech companies to pick from worldwide. Amid so much variety, merchants must know the industry practices used by payment processors and communicate what risks they see.

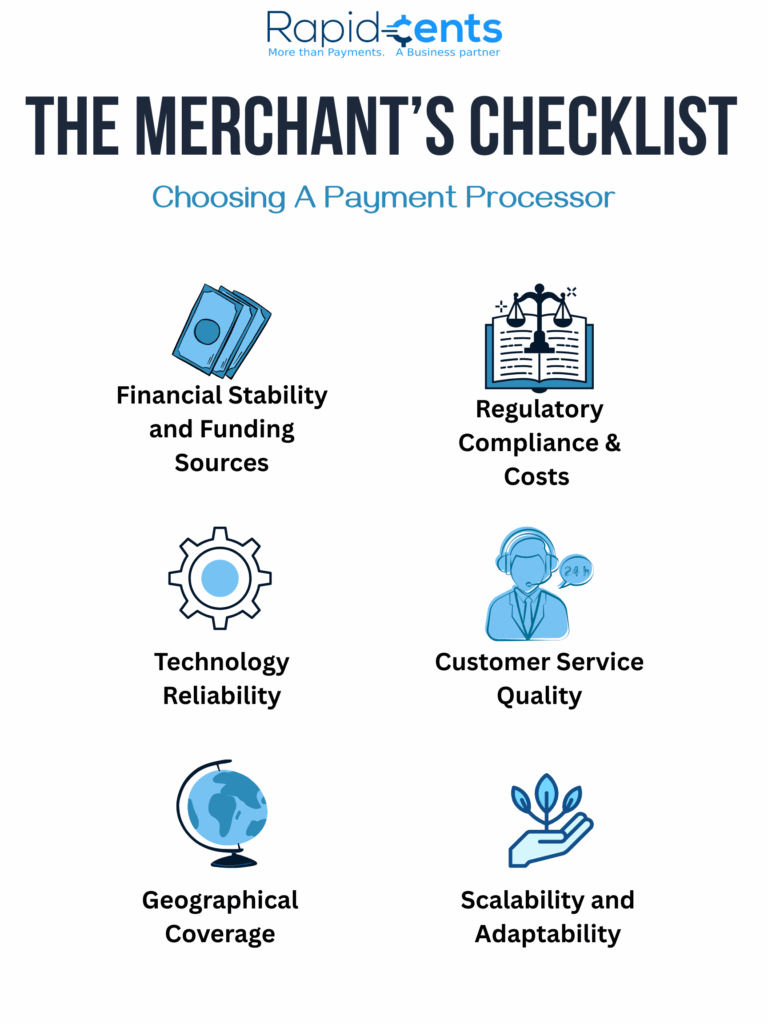

Here’s a practical checklist for merchants to properly vet payment processors:

1. Financial Stability and Funding Sources

- Industry Trend: Venture capital, debt, or private equity is what a lot of processors depend on.

- Potential Risk: Depending too much on loans can lead to credit problems, especially when economic times are tough.

Merchant tip: Request specifics about your provider’s financial health and funding sources.

2. Regulatory Compliance and Hidden Costs

- Industry Trend: Payment processors are facing stricter compliance as new regulations, including the EU’s MiCA framework and RBI’s fintech regulations, come into play.

- Potential Risk: Some processors may shift compliance costs to merchants using unclear structures or hidden fees.

Merchant tip: Request transparency for regulatory fees and compliance costs upfront.

3. Technology Infrastructure and Reliability

- Industry Trend: It’s common practice for Processors to utilize cutting-edge technologies, including artificial intelligence, blockchain, and mobile optimization, to elevate payment experiences.

- Potential Risk: Innovative tech leads to the best customer experiences, but can also ruin them for you if you don’t have a back end to support the tech.

Merchant tip: Research how reliable providers are and whether they guarantee uptime.

4. Customer Service and Responsiveness

- Industry Trend: Numerous processors advertise themselves as personalized, having fast customer service as an area of differentiation.

- Potential Risk: Responsiveness and quality of customer service may drop when providers become larger.

Merchant tip: Try customer support channels and see how they respond, to get a view of the long-term service consistency.

5. Geographical Reach and Expansion Capabilities

- Industry Trend: A provider may focus on a geographic area, excelling in localized solutions or niche markets.

- Potential Risk: Limited geographical reach may hinder a merchant’s expansion opportunities, particularly internationally.

Merchant tip: Make sure the provider covers the geographic locations where you have, or plan to have, a market presence.

6. Scalability and Adaptability

- Industry Trend: Payment processors often claim scalability and future-proofing.

- Potential Risk: Not all providers can easily expand operations, despite marketing the ability to do so.

Merchant tip: Carefully examine scalability evidence, including references and case studies, to verify claims.

Final Thoughts: Choosing Wisely Amidst Abundant Options

When you sift through 30,000 payment processing alternatives, a careful analysis comes into play, which is much more than just pricing. It is essential to keep an eye on vulnerabilities, financial solvency, hidden fees, technology dependability, the quality of customer service, the geographical scope of the provider, and the potential for scale.

This way, merchants can trust that they are making decisions that are aligned with the long-term health of their business and avoid exposure to potential sensitivities in the future.

(Source: https://www.marketline.com/: MarketLine Industry Profile, Global Financial Technology (FinTech), February 2025)

Still Can’t Choose a Payment Processor?