Abandoned carts and failed transactions are the most expensive problems for brands in this digital economy. Abandoned carts and transaction failures are not marketing or sales errors, but rather highlight gaps in payment processing systems.

While brands lose money due to these errors, they also risk losing brand loyalty, customer satisfaction, and long-term growth. So, not fixing these issues and the underlying problems can prove to be a huge business risk in 2025.

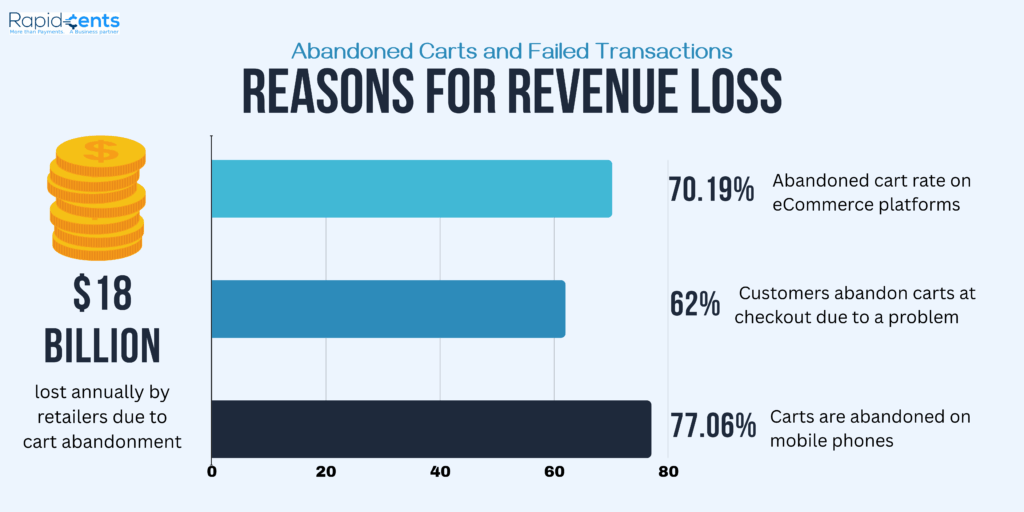

The Stats of Revenue Loss to Abandoned Carts and Failed Transactions

Let’s look at the statistical damage caused by neglecting to solve the snag in your sales funnel.

- $18 billion is lost annually by retailers due to cart abandonment1.

- The average abandoned cart rate is 70.19% on eCommerce platforms2.

- 5%-10% of online payment attempts fail for a range of reasons worldwide3.

- 62% of customers abandon the cart at checkout if they encounter any problems4.

- 77.06% of carts are abandoned on mobiles, mostly due to a bad user experience5.

Why Carts are Abandoned

As per a recent study conducted by Baymard, these are some of the reasons for customers abandoning their carts:

- Unexpected Costs

Unexpected costs such as shipping rates, taxes, and service fees are the reason almost 39% of customers abandoned the cart at checkout.

- Account Creation

19% of customers abandoned their carts because the site required them to create an account to check out.

- Security Concerns

Doubts about the security of the payment platform caused over 19% of customers to abandon their carts.

- Complex Checkout Process

Approximately 18% of customers abandon their carts due to a long or complex checkout process.

- Limited Payment Methods

10% of customers abandon carts because their preferred method of payment is not available.

Reasons for Transaction Fails

- Payment Gateway Downtime

Just 1% downtime of a payment processor during prime time could result in a loss of millions in revenue, especially for large merchants.

- False Declines

In 2014, 15% of valid payments were labeled suspected fraud, resulting in 32% of the customers stopping shopping at the brand completely6.

- Outdated Card Details

Over 13% of recurring payments fail every month, with one of the most common reasons being expired cards7.

- 3D Secure Failures

Approximately 22% of payments drop off during authentication with 3DS, often as a result of bad UX or time-out problems8.

Why It Matters For Businesses

- Because You Have Already Paid to Get That Customer

Whether you do paid search, influencer campaigns, or organic, every single person on your checkout page costs money. If it costs you $30 to $50 to acquire one new customer in a certain niche, but that new customer abandons their cart or the payment fails, then you’re not just not making a sale, you’re wasting marketing spend.

Which is why smart brands already view checkout optimization and payment success as part of their acquisition cost strategy.

- As Bad Payment Experiences Destroy Lifetime Value

Many businesses spend so much effort on funnel-topping that they overlook the most important moment: payment. Your product may be loved by customers, but if their favorite wallet isn’t supported or their card is unfairly declined, they won’t return. And it’s not just lost revenue, but brand loyalty and retention are also reduced.

- As Trust and Seemlessness Create Revenue Lifts

Today’s consumers have high standards. They don’t want to retype card details, wait for slow authentication challenges, or try to make sense of an unrecognizable error message. A frictionless and sticky checkout experience can build trust with customers, while even the smallest friction or delay can drive them away to never return.

You can attract customers and have them make repeat purchases by using a payment processor that allows you to:

- One-click checkout

- Support for wallets (Apple Pay, Google Pay, etc.)

- Good clean UI and responsive flows from mobile

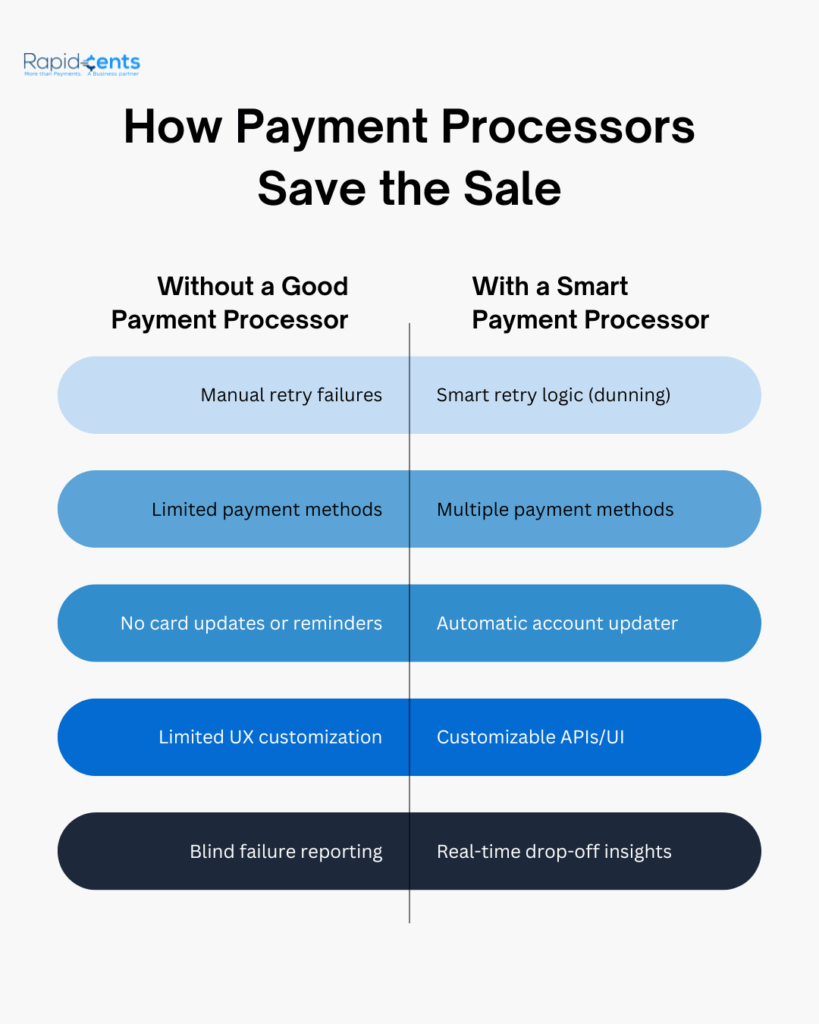

How a Payment Processor Assists You in This

With the right payment processor, you have a mission-critical part to play in eliminating abandoned carts and failed transactions. Here’s where it fits into your strategy:

- Success Rate Boost to Checkout

Supporting various payment methods, fallback techniques, and intelligent routing to the most reliable acquiring bank can help a payment processor increase the rate of approvals at scale or with riskier card types.

- Creates a Seamless Experience for the User

And also that those APIs and hosted checkout solutions are fast, mobile-first, and customizable so that your checkout looks and behaves differently per user, device, and preference.

- Provides Data and Insights on Drop-Offs

A modern payment system provides transaction-level visibility: exactly where the payment failed, why it failed, and what you are going to do about it. This allows you to limit your unknowns and to do something and iterate quickly.

- Compliant With Full Support for UX

Security is imperative, but it shouldn’t mean making sacrifices in terms of ease of use. The right processor will take care of PCI compliance, 3DS authentication, and do some tokenization, but it will let you create a branded, smooth flow for the end user.

Strategies for the Future: What Leaders Are Doing in 2025

As digital commerce advances, so do the tactics employed by top-performing companies to safeguard revenue and enhance the customer experience, and drive customer loyalty. By 2025, top-tier businesses will no longer reactively address abandoned carts and failed transactions; they’re predicting them. Here are the creative tactics that are making them different:

- Smarter Payment Predictions

Now, companies can not only anticipate when a transaction might fail, but they can also proactively do something about it by utilizing AI. Such as: fallback payment methods or bypassing needless verification for tested users.

- Personalized Checkout Paths

Instead of a single, predetermined checkout, companies display different flows for different users. A repeat customer, for instance, could see a quick, one-click option, such as pay now, while for new users, the guidance is more deliberate.

- Payment Retry with a Better Logic for Failed Payments

When a payment fails, top brands definitely do not just retry blindly. They:

Wait for payday

Indicate to users to update their card information.

Space out your retries for a higher success rate

It helps recover failed subscriptions or charge revenue.

- Offering More Ways to Pay

Leaders are extending payment options: wallets, buy now, pay later, even crypto, to make it easier for every customer to pay you regardless of device or location.

- Real-Time Communication

Shoppers get alerts like:

“You are ready to purchase?”

These small nudges can lower drop-off rates and increase trust.

- Testing Checkout Elements

Just as if you’re A/B testing ads, smart brands are testing checkout buttons, checkout form layouts, checkout, and payment methods to see what converts better.

It’s Time to Talk About the Leaks

In 2025, it is no longer the product or the price that going into competition, it is who has the highest conversion experience. Cart abandonment/ failed transactions are not only UX concerns but also killer revenue and trust wreckers.

The good news? You can fix both of those with the correct tech stack, retry logic, smart routing, and most importantly, a frictionless checkout journey that reassures and empowers your customer to transact time after time.

With RapidCents, you can recover your lost revenue with real-time monitoring dashboards, account updater, multiple payment methods, automatic retry logics, and much more.

Learn More about our Online Payment Gateway.