Late payments are not just annoying, they are disruptive. For a lot of Canadian companies, waiting on overdue invoices isn’t just a problem of cash flow; it sets off a chain reaction that impacts operations, drives debt, and halts growth.

As per the Atradius Payment Practices Barometer 2024, only 48% of B2B invoices in Canada get paid on time. It means that more than half of the payments are delayed or written off entirely, and these delays cause a rippling effect that impacts more than just a pay stub.

The Result of Late Payments for Canadian Companies

As per the report1, the Canadian businesses affected by late B2B payments had to take measures to keep their business running despite late payments.

- 33% delayed their investments

- 32% delayed in paying their staff or bills

- 31% slowed payments to their suppliers

- 27% had to increase borrowing to stay afloat

- 24% struggled to meet other financial obligations

The Domino Effect of a Single Late Invoice

This study helps you realize that the delay in payments can lead to a major disruption in business operations.

Let’s say a customer delays a $10,000 payment. What happens next?

- You postpone upgrading a piece of software or a type of tool

- You draw down cash reserves or delay payrolls

- You extend vendor payments, causing friction or late fees

- You look at a short-term loan, adding more debt

- You get distracted by chasing payments instead of building the business

And when this behavior is repeated across multiple clients or quarters, the price is not just monetary. It undermines operational stability and trust, internally as well as throughout your supply chain.

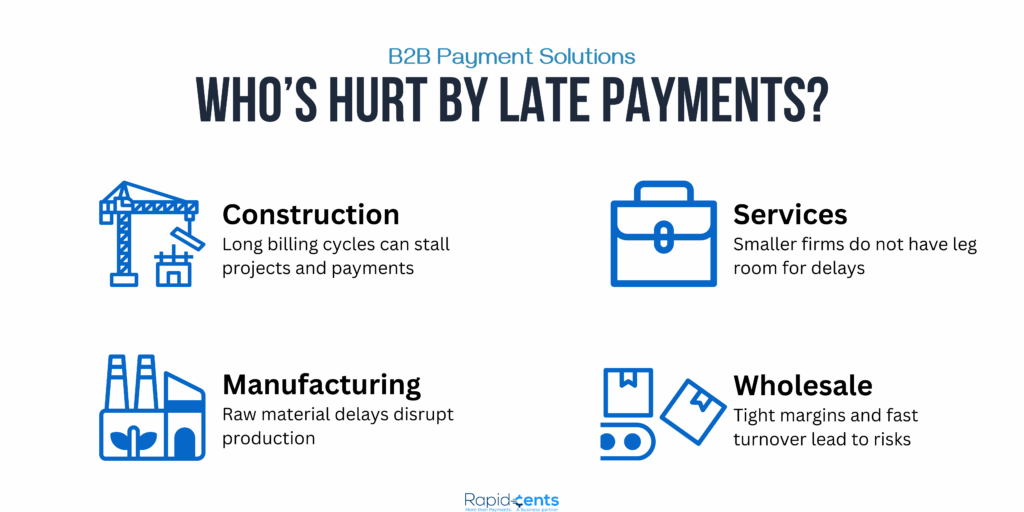

Who’s Hurt Most by Late B2B Payments?

The effect of late payment is not the same for all businesses. Industries are more exposed in some sectors. There are a number of reasons it may happen: a long billing cycle, a complex project, thin operating margins, or some combination of all three.

Most at-risk industries include:

- Construction & Trades: Lengthy project schedules and multiparty billing make delays frequent and perilous. Delays in cash flow can grind projects to a halt in progress.

- Manufacturing: Late payments result in delays in ordering raw materials or paying workers, in turn delaying production and affecting the reliability of a supply chain.

- Professional Services: Agencies, consultants, and B2B service firms are generally smaller teams without deep pockets. Small hiccups can affect the operation, too.

- Wholesale & Distribution: These businesses often extend credit to customers and require fast payment to keep up with their rapid inventory turnover.

Tip: If you are in one of these industries, payment automation is not just convenient, it is a necessary part of your business’s ongoing operations.

What’s Driving the Problem?

A number of root causes are fuelling the B2B late payment epidemic:

- Lack of automation: Many companies are still making invoices and follow-ups manually

- Loose credit terms: “Net 30” becomes “Net 60” with nothing being enforced

- Decentralized systems: Various types of payments, operations, and accounting are not connected

- Weak visibility: Organisations are unable to follow up on aging invoices in real-time

- Cultural inertia: Companies are allowed to pay late because “Everyone in B2B pays their bills late.”

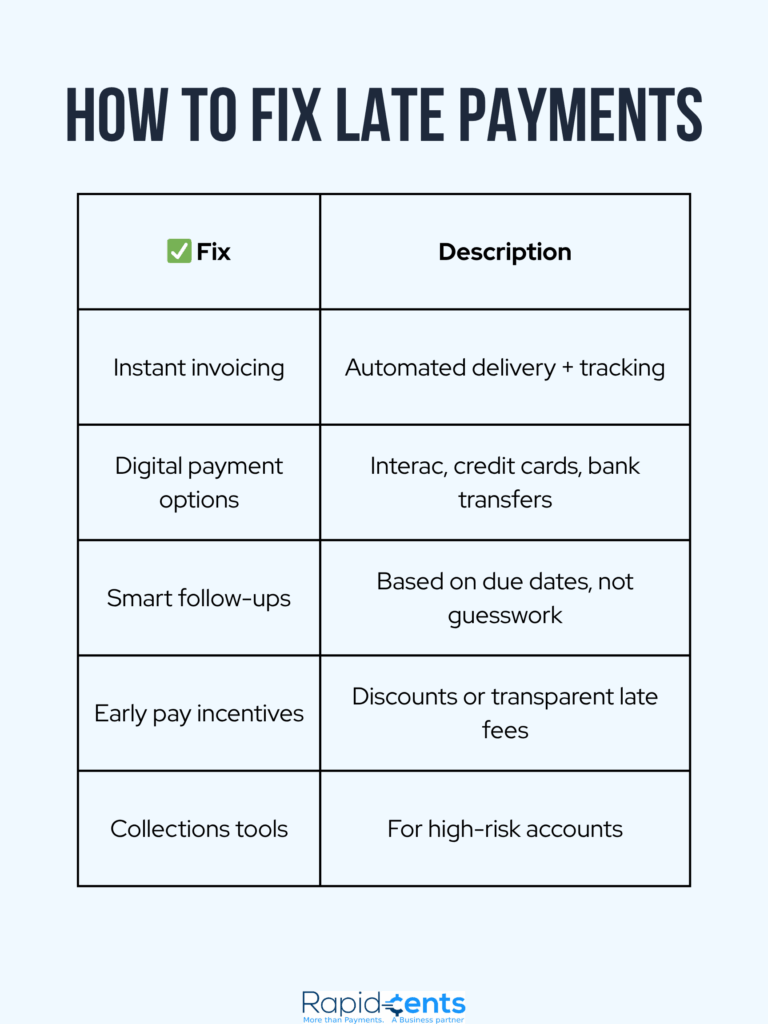

What You Can Do About It

The key to fixing this isn’t just sending reminders. It’s more about reimagining how you get paid:

- Streamline your invoicing with instant delivery and tracking

- Accelerate digital payments such as Interac, credit cards, or bank payments

- Utilize smart follow-up logic that is date-triggered and requires no guesswork

- Encourage early payment, or have transparent late fees

- Think about collections assistance or credit insurance for high-risk buyers

Most importantly: choose a payment partner that helps you reduce friction and get paid faster.

Final Thought: Payments Aren’t Just Back-Office Admin, They’re Strategic

Every late payment is a liability. It slows momentum, increases borrowing, and forces you to play defense with your cash flow.

But with the right tools, processes, and partners, you can turn receivables into a reliable revenue engine — and protect your business from the domino effect of delay.

Want to stop chasing payments?

RapidCents helps Canadian businesses get paid faster with automated billing, smart reminders, and real-time payment tracking.

Book your free payment audit →

Also, check out our payment solutions and learn how they boost your business