In a world where digital wallets, buy-now-pay-later apps, and even crypto promise faster ways to pay, it’s still the card most customers pull out.

65% of online payments are still credit and debit card-based, as per Payments and Commerce Marketing Intelligence.1

And that’s not just an interesting thing to know.

It’s a business alert.

If your payment stack isn’t built for card transactions, you’re losing out on money and conversions.

Let’s explore why cards reign supreme, what your customers are looking for, and ways that you can turn every one of those sales into an opportunity to boost your revenue.

The Stats Behind the Swipe

In the digital-first economy, using a credit card or debit card has become the de facto way to pay, especially online.

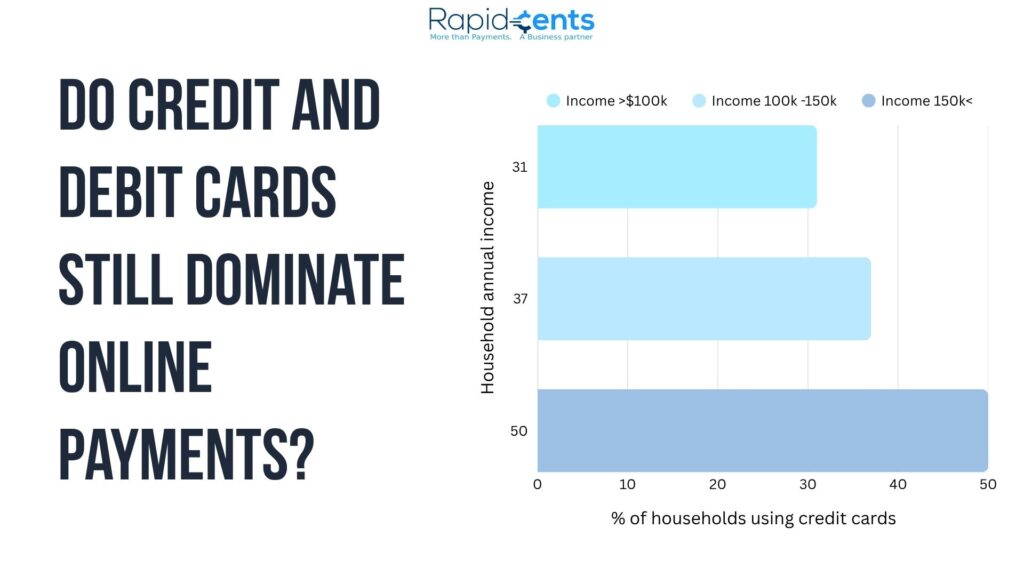

According to a study by the Federal Reserve of San Francisco, 31% of all monthly purchases by American consumers in 2022 were made with credit cards. It’s a trend apparently characteristic of consumers’ increasing move away from cash and checks and towards card usage. And the pattern is especially clear as income rises:

- For households with an annual income of $100,000, credit card usage jumps to 37%

- For households earning above $150,000, it reaches 50%

That means the higher your customer’s spending power, the more likely they are to reach for a credit card, especially when buying online.

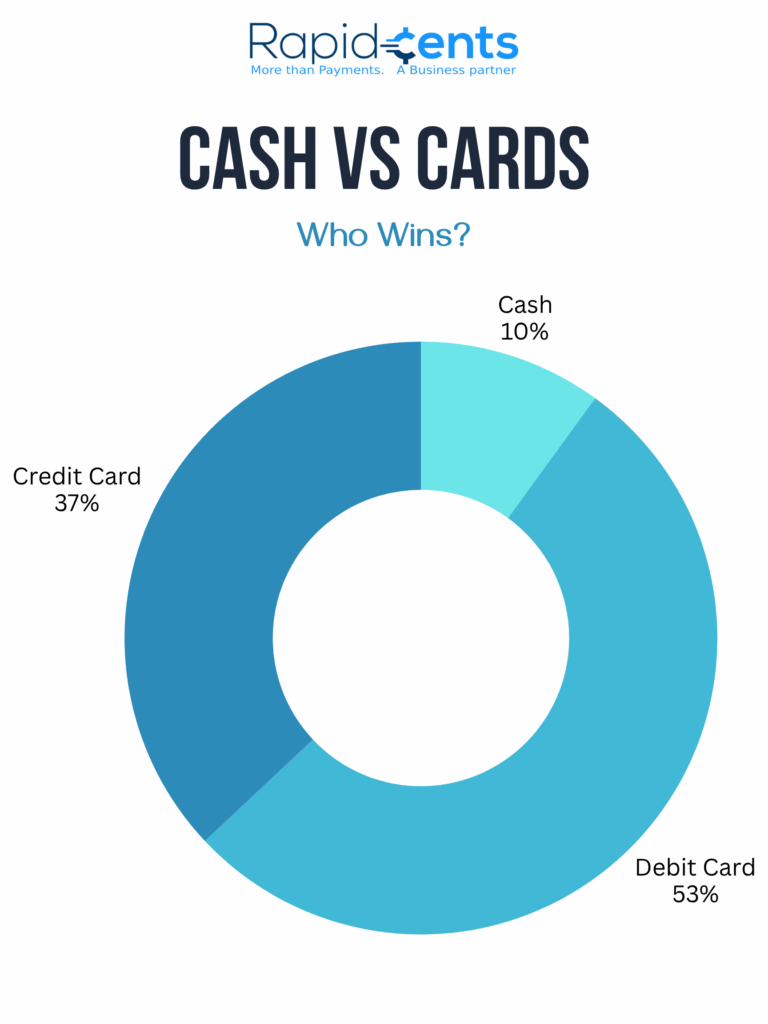

A newer 2023 Forbes Advisor survey serves up an even sharper portrait of what’s going on now:

- Approximately 10% of Americans still use cash as their primary payment method

- 53% use debit cards (physical or virtual) as their go-to

- 37% rely mainly on credit cards for payments

Together, that’s a whopping 90%+ of consumers preferring cards over alternative payment methods.

So, for businesses, it is a reminder that if your strategy and payment solutions are built around card payments, you’re creating friction in the most critical part of the customer journey.

Why Consumers Still Prefer Cards

Despite all the fintech disruption, consumer behavior isn’t changing overnight. Here’s why cards remain the go-to:

1. Trust and Familiarity

Cards have been around for years. Customers trust them as they know the process. It also has a reputation for safety in the checkout process.

2. Rewards and Perks

From cashback and points to air miles and exclusive discounts, it also offers real value back. For most alternatives, it’s hard to compete.

3. Buyer Protection

The credit card networks have fraud protection and chargeback rights. Consumers also know that if something goes wrong, they’re covered.

4. Universal Acceptance

Cards work everywhere. Whether at a boutique Shopify store or a large global retailer, card acceptance is the norm.

What This Means for Merchants

If you’re accepting 65% of your online payments via cards, you have to be strategic about how you’re going to do that. Here’s what that looks like:

Make It Easy to Pay with Cards

- Don’t hide the card choice behind digital wallets.

- Autofill, scan cards, and real-time validation make things even faster for you.

- Save cards safely for returning customers using tokenization.

Keep It Secure (Without the Friction)

- Employ PCI-compliant technology so you’re not on the hook.

- To drastically reduce fraud without sacrificing conversions, implement 3D Secure and utilize smart routing.

- Provide trust badges and a clear security message on checkout.

Boost Performance with the Right Tools

- Opt for payment gateways that automatically retry failed transactions.

- Enable automatic card updater features.

- Route intelligently to reduce false declines from banks.

The Hidden Dangers of Poor Card Payment Setups

Here’s where it hits: customers may be favoring card payments, but a poorly designed system can still send them away from checkout.

High Decline Rates

Many declines aren’t about fraud at all; they’re due to weak gateway setups or incorrect details. Smart decline management can save revenue in the moment.

Chargebacks

Not all disputes are fraud. Some are when the customer didn’t recognize the charge. These losses are minimized using clear descriptions and fraud tools.

Processing Fees

Each time a card is swiped, it incurs an interchange fee, but not all processors are created equal. Know what you pay, and for what. You may be overpaying for the standard procedure.

Cards Aren’t Going Anywhere, But They Are Evolving

Yes, new payment methods are gaining attention.

But cards are evolving too:

- Network Tokenization is helping make transactions safer and easier

- Tap-to-Pay on Mobile is bringing cards to the contactless future.

- Embedded cards in wallets blur the line between card and digital.

Meaning: Optimizing for card payments isn’t outdated, it’s forward-thinking.

The Bottom Line: Be Card-Ready, or Risk Losing Sales

The numbers speak for themselves: When it comes to online payments, 65% of them are done by credit and debit cards.

If your checkout isn’t optimized for the majority:

- You’ll see more abandoned carts

- You’ll deal with higher decline rates

- And you’ll miss out on repeat customers who expect frictionless payments

Want to fix that?

At RapidCents, we help businesses:

- Improve card acceptance rates

- Reduce chargebacks and hidden fees

- Ensure a safe and smooth card payment experience

For when your payments partner supports your growth, your possibilities are endless.