Credit cards aren’t just convenient anymore, they’re the standard. To keep your online shop, brick-and-mortar store, or subscription-based business running, you most likely depend on credit card payments for the majority of your sales.

Customers love the smooth payment experience, but the vast majority of merchants get lost in the maze of unclear fees, slow payouts, chargebacks, and compliance issues.

The truth? Understanding how credit card processing works can help you cut costs, reduce fraud, and increase sales for both your business and your customers.

What Is Credit Card Processing?

Credit card processing is the mechanism that transfers money from your customer’s card to your bank account.

The journey involves multiple players:

- Cardholder: The person who is buying something

- The Merchant: Your business

- The Payment Gateway: Gathers card information on the web

- The Payment Processor: Sends info and helps secure authorizations

- The Issuing Bank: The bank of the customer

- The Acquiring Bank: The bank where your business accounts are held

When a customer pays with a card, the payment processor sends out an authorization request to the bank that issued the card. When accepted, the money is placed on hold and later “settled” to your account.

This all takes seconds, but behind the scenes, it’s a multi-layered system that impacts your cost, risk, and speed of payout.

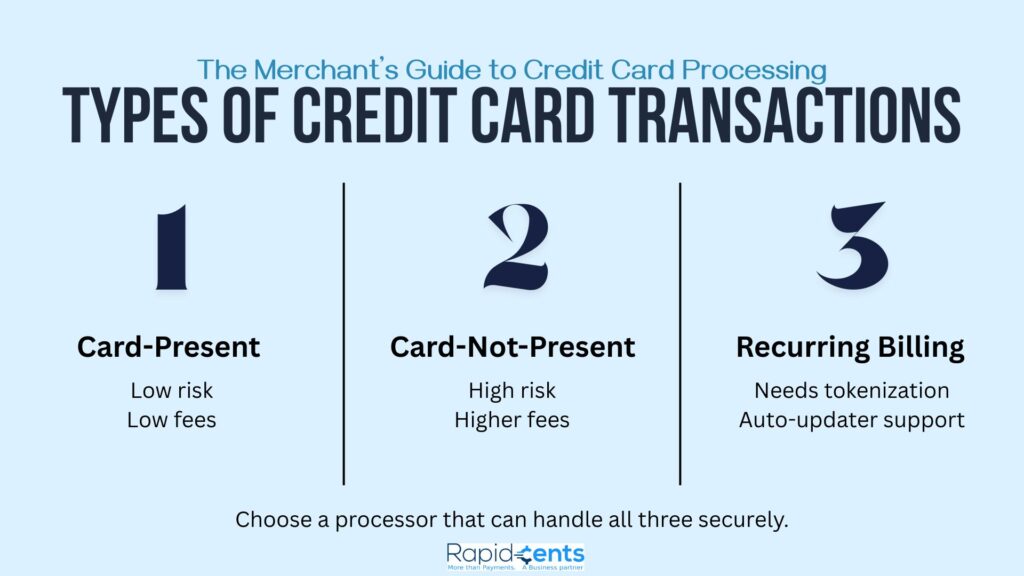

Types of Credit Card Transactions

All transactions are not the same. Knowing the types of credit card payments can also help you choose the best tools and minimize fees.

1. Card-Present Transactions

For in-store payments, where the card is physically tapped, dipped, or swiped. These transactions are of a lower risk and have a lower processing fee.

2. Card-Not-Present Transactions

This applies to online, mobile, auto pay, and phone payments. Because the card is not with you physically, they are riskier, and they usually involve higher fees and more stringent fraud checks.

3. Recurring Billing

Recurring billing systems are those where customers are billed automatically on a set schedule, such as monthly or annually, for subscriptions or member-based businesses. They require additional security measures, such as up-to-date tokenization, to prevent declined charges.

Tip: Get a processor that supports smart updater tools so recurring transactions never fail.

The Anatomy of Credit Card Fees

One of the most perplexing aspects of credit card processing is the fee. Here is what constitutes each cost:

1. Interchange Fees

These are established by card networks (like Visa, Mastercard, etc.) and paid to the issuing bank. They depend on the type of card, how the transaction is done, and in what industry.

2. Assessment Fees

Charged by the card networks to cover operational costs.

3. Processor Markup

This is the charge from your payment provider. It’s the one you can control when selecting a provider.

4. Monthly or Hidden Fees

Certain processors assess extra charges for such services as PCI compliance, customer support, statement generation, early termination, etc.

Rather than comparing providers based on their “rate,” compare your effective rate — the percentage of revenue you keep after all fees.

Settlement and Funding Times

Once a payment is processed, the funds must be settled and deposited into your business account. It typically takes 1–3 business days.

But some providers take longer to pay out or hold a reserve if you’re in a high-risk industry.

Questions to Ask:

- How long does it take for money to be deposited into my account?

- Do you hold rolling reserves?

- Are weekends or holidays considered part of the settlement days?

Remember: Cash flow matters. Long delays to payouts can strangle your systems.

Security, Fraud, and Compliance

Managing credit cards means managing sensitive financial data. You must meet security requirements, and failing to do so can lead to penalties and, in some cases, losing your processing privileges.

Key Security Concepts:

- PCI DSS Compliance: Merchants must adhere to these regulations to store, process, or transmit card data securely.

- Tokenization: Replicates card numbers with a secure token.

- Encryption: Encodes data so hackers can’t read it.

- 3D Secure (e.g., Verified by Visa): Provides an additional level of authentication.

- AVS and CVV Checks: Verifies billing address and security code.

Note: A good processor will help you implement these tools and keep your business safe.

Chargebacks: The Silent Profit Killer

A chargeback occurs when a customer disputes a charge and asks their bank to reverse it.

Common reasons include:

- Fraud or unauthorized use

- Item not received

- Product or service not meeting the expectations

- Subscription confusion

It’s not just the lost revenue; chargebacks come with additional fees and damage your standing with the payment processors. If your chargeback rate exceeds 1%, you’re classified as high risk.

Preventing Chargebacks:

- Use clear billing descriptors

- Deliver order confirmations and tracking information

- Offer simple refund policies

- Provide responsive customer service

- Use fraud detection tools

Even better, pick a processor that provides you with instant chargeback alerts and automated dispute responses like RapidCents.

The Importance of a Reliable Payment Provider

Your Payment provider is more than just a processor – they are your cash flow teammate. You don’t want some weak provider selling you bad service, or hitting you with hidden fees, or failing to protect you.

What to Look for:

- Clear pricing (flat rate or interchange-plus)

- Fast and predictable payouts

- Built-in fraud prevention tools

- Support for the type of business model you operate (eCommerce, SaaS, POS, etc.)

- 24/7 support and onboarding help

- Tools for subscriptions, analytics, chargebacks, and PCI

At RapidCents, we help ambitious companies succeed with an all-in-one payment platform built to scale your growing business — fast, with no surprises.

Final Thoughts: Payments Should Work for You, Not Against You

You don’t need to become a payment expert, but you do need to understand the basics. Knowing how credit card processing works gives you leverage to:

- Lower your fees

- Speed up your payouts

- Chargeback prevention

- Protect your business from fraud

- Deliver a better customer experience

Because in a competitive market, every transaction matters.

Ready to simplify your payments and maximize your margins?

Talk to a RapidCents Specialist