Subscription billing isn’t just for streaming anymore. This billing method holds the power for small and medium businesses to create a predictable cash flow, increase customer loyalty, and reduce acquisition costs.

According to a report by Deloitte, customers prefer a subscription model not just for media but also commodity services, insurances, utilities, and marketplaces1.

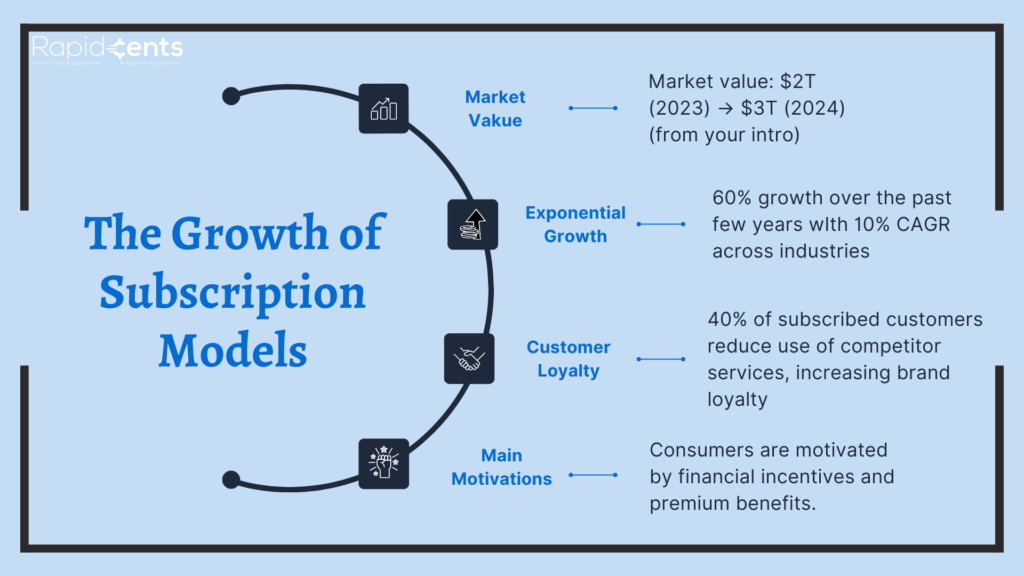

Businesses are noticing that subscriptions and recurring billing have grown drastically in the past few years and are expected to grow over the coming years. The estimated value of the subscription and loyalty industry has gone up from $2 trillion in 2023 to $3 trillion in 20242.

Key Industry Statistics for Recurring Billing

- Over the past few years, subscriptions have grown by 60%, with industries observing a combined annual growth rate of 10%3.

- Add-on options offered by Recurly merchants resulted in an increased revenue of $2.2 billion in 20234.

- 40% of subscribed customers reduce the usage of other similar services, fostering customer loyalty for the brand5.

- 61% of customers are willing to pay more on their mobile or internet bill if it is bundled with subscriptions6.

Why Consumers Choose Recurring Billing Plans

While convenience used to be the primary motivation in the past, financial incentives have become the driving force for customers choosing subscription plans.

- Loyalty programs and convenience (such as removing ads on platforms) are also major factors that influence the decision to opt for a subscription plan.

- Subscriptions that offer free trials are more likely to convert customers into paying subscribers. Customized plans that offer flexibility and add-ons see an increase in yearly revenue.

- A more attractive price and premium benefits encourage consumers to switch to subscriptions and, in effect, increase the loyalty to the brand. This makes a perfect opportunity for new players to introduce subscription plans that offer their clients added benefits.

Motivations for the Subscription Model

While global digital subscriptions and streaming platforms account for the most revenue generated through subscription models, statistics show that subscription e-commerce holds 10.2% of the industry, followed by Saas and social media submarket at 7.9%7.

As per Deloitte’s Report, customers across industries, be it digital services, traditional services, products, or e-commerce, are willing to switch to subscriptions for the right benefits. These are the top motivators for customers according to the same report:

- Attractive pricing

- Discounts and offers

- Premium Services

- Glowing Recommendations

- Advanced functionality

- Flexibility

So, whether you’re providing goods or services, subscriptions have the power to grow your revenue, provide predictable cash, and foster loyalty without any major operational changes.

The Trend in Payments for Recurring Billing

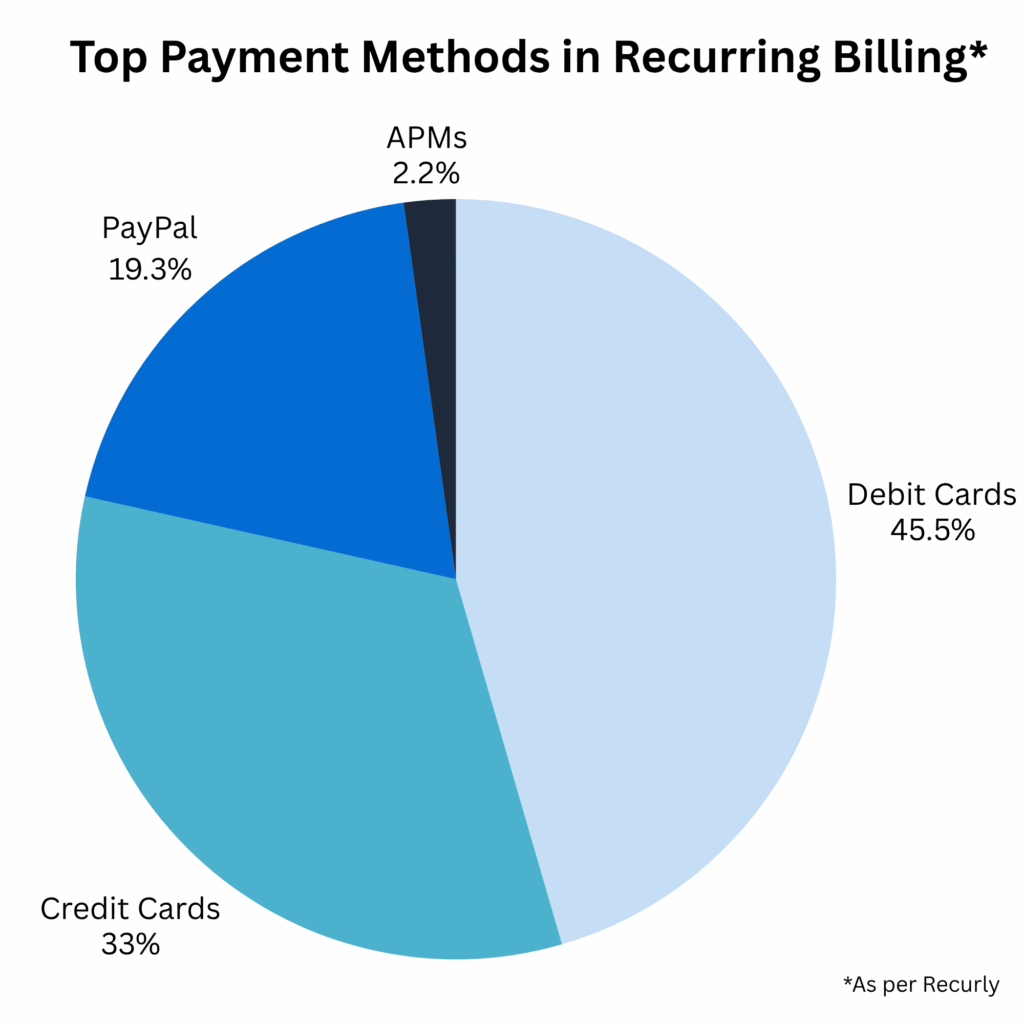

According to Recurly, consumers prefer subscriptions that offer personalization and flexibility, including multiple payment methods. The breakdown of global transactions on Recurly showed:

- 45.5% of purchases were completed using debit cards

- 33% of customers paid using credit cards

- PayPal was a chosen payment method for 19.3%

- While 2.2% used alternative payment methods

Businesses with recurring billing plans must offer various payment methods for their customers to choose from. However, subscription churn rate can increase due to failed payments from expired or declined cards. Payment method updates, automatic reminders, and smart retries can help reduce this number.

Stay ahead of the data and the competition. Read our Ultimate Guide to Recurring Billing for actionable steps to scale your business.

What Does Recurring Billing Mean for SMBs

With the current popularity of subscription models, brands that offer services and products with the potential for recurring billing can leverage this to get ahead of competitors, grow revenue, and get a fixed cash flow for the business.

Whether you are a gym, healthcare clinic, tech company, or eCommerce store, recurring billing gives you:

- Improved customer retention and loyalty

- Lower Acquisition Costs

- Predictable Cash Flow

- Upselling Opportunities

Recurring billing allows you to grow your revenue, retain your customers, all without modifying your operations too much.

Which Businesses Should Offer Recurring Billing

Businesses that provide regular services or goods to their customers can set up recurring billing. Here are the most common industries that should consider subscriptions and recurring billing as a part of their business strategy:

Streaming Platforms:

While the most popular industry offering subscriptions, they allow customers to choose from various plans, from the cheapest with ads and one-user access to the premium with ad-free content across multiple devices.

Membership-Based Businesses:

Fitness studios, gyms, and libraries can set up recurring billing. Members can be charged monthly, annually, or with customized options to maximize flexibility.

Saas Companies:

Companies that offer software services, hosting platforms, management tools, and accounting software run on recurring payments. Customers choose from monthly plans or yearly ones that often offer discounts.

Digital Services:

Online coaches and courses have monthly or annual models that let customers access all their courses, ebooks, and classes. Popular online learning platforms also run on the same model.

Food and Beauty Industry

Tiffin services, meal kits, and even beauty products are now offered on various subscription models. Customers can customize based on their needs and get the goods delivered to their homes.

Utilities

Businesses that provide essential services and products such as electricity, water, internet, and mobile services have a monthly model where payments can be set up automatically.

Power Your Subscription Billing With RapidCents

If your business is ready to focus on recurring billing, RapidCents makes it easy to get started and start earning.

- Customized subscription models with free trials

- Automated reminders and emails

- Retry or notify customers about failed payments

- Stay safe with tokenization and PCI compliance

- Easy integration with existing platforms

Whether you are creating your first subscription plan or scaling an existing one, keep full control and customize your payments with RapidCents.