As digital payments become the backbone of modern commerce, the dark side of online transactions- chargebacks and payment fraud is growing just as fast.

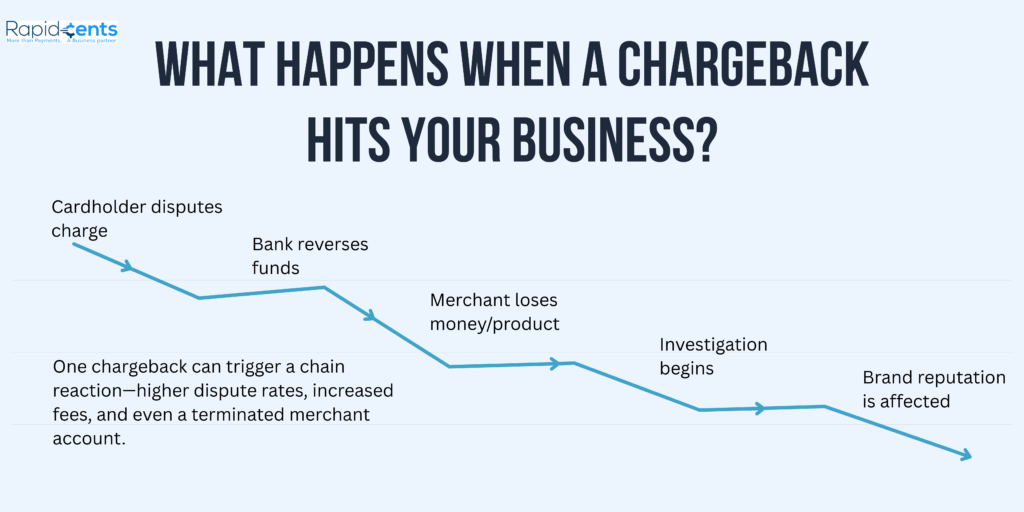

For merchants, chargebacks are more than just lost revenue; they can chip away at profit margins, customer trust, and even merchant accounts. In 2025, when fraudsters are more sophisticated and consumers are more empowered, having a solid chargeback prevention strategy is crucial.

What Are Chargebacks and Why Do They Happen?

A chargeback happens when a cardholder disputes a transaction with their bank and the bank reverses it. Chargebacks are designed to shield consumers from fraud, but can be financially damaging for a merchant, especially if they come after a product has been delivered or a service provided.

Common Reasons for Chargebacks

Understanding why chargebacks occur is the first step to preventing them. Here are the most frequent causes:

- Fraudulent Transactions: Unauthorized charges made with stolen card data.

- Friendly Fraud: The customer makes a purchase and later claims it was unauthorized.

- Product Not Received: The customer says they never got the product, even if it was shipped.

- Product Not as Described: The item didn’t match what was advertised.

- Subscription Confusion: Charges for renewals or forgotten subscriptions.

- Duplicate or Incorrect Billing: Overcharges or being billed multiple times for the same item.

How Can I Fight a Chargeback?

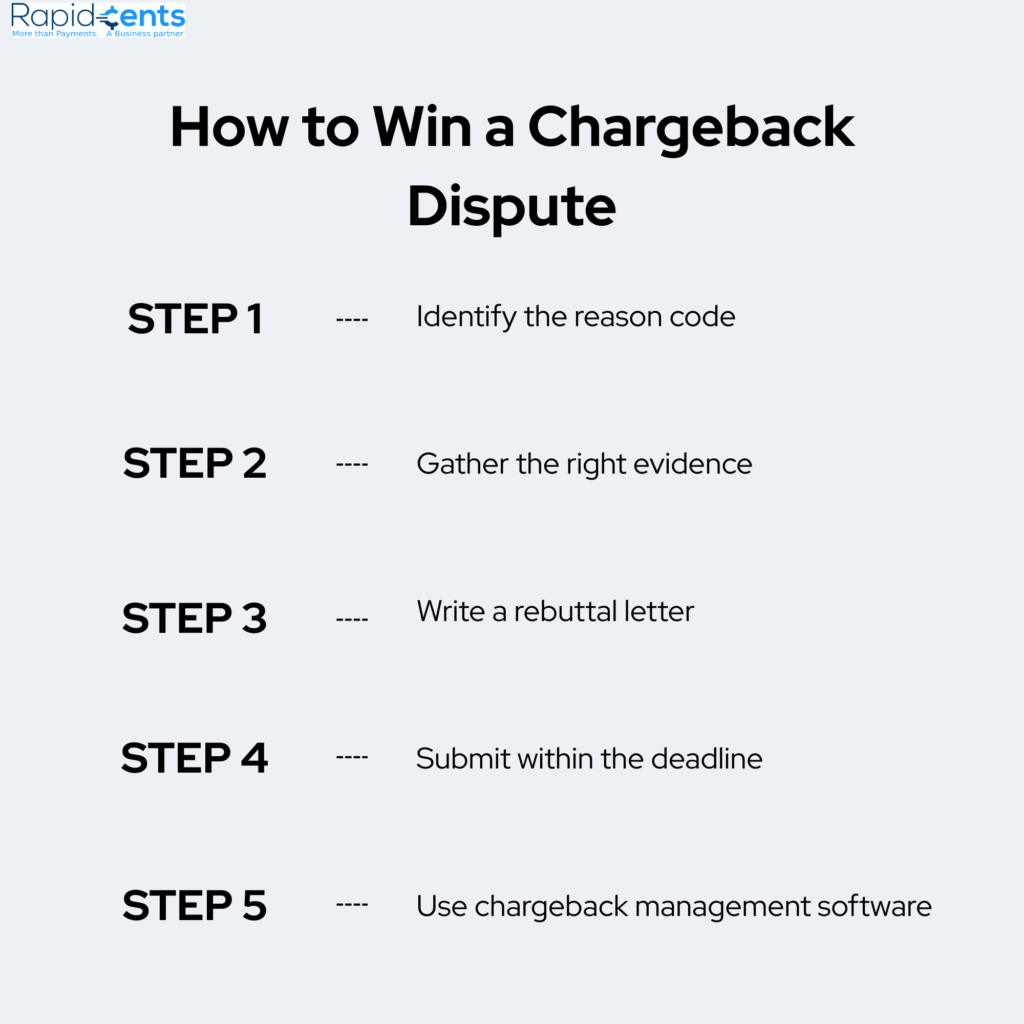

The practice of fighting against a chargeback is called representment. It requires you to gather and present evidence to your cardholder’s bank that the payment in question was valid.

Steps to Fight a Chargeback

- Identify the Reason Code: Each chargeback comes with a reason code that tells you what kind of evidence you need to submit.

- Gather Evidence:

- Order confirmation emails

- Shipping and tracking details

- Screenshots of product listings

- Customer communication (email, live chat)

- IP address and device ID used in the transaction

- Write a Rebuttal Letter: Keep your letter concise and focused while clearly explaining why the dispute is invalid, referencing the evidence.

- Submit Within Deadline: Most card networks require your evidence submission within 7 to 30 days.

- Use Chargeback Management Software: Platforms like RapidCents help you through the entire process and increase your chances of success.

What Is Chargeback Insurance and Should I Get It?

Although you should be contesting chargebacks, chargeback insurance serves as a backstop by reimbursing you for qualified contested transactions.

How It Works

- You pay a transaction fee or a monthly fee.

- If a chargeback happens, your insurance company (especially in fraud), investigates.

- If you’re approved, you’re refunded the lost money, even if the bank ultimately supports the customer.

What It Typically Covers

- Use Of Unauthorized Credit Card (Criminal Fraud)

- Chargeback fraud (in some instances)

- Failures in logistics (e.g., item not delivered)

What Are the Most Common Types of Payment Fraud in 2025?

Fraudsters aren’t just lone hackers any longer; they’re part of organized crime rings deploying increasingly sophisticated tactics. Below are the fraud types most businesses face today:

Top 6 Types of Payment Fraud

- Card-Not-Present (CNP) Fraud

Occurs when transactions happen without a physical card (e.g., online). Most common and hardest to prevent.

- Account Takeover

The fraudster has access to a customer’s account and makes a scam purchase.

- Synthetic Identity Fraud

Accounts are created by using false identities made with real and fictitious information.

- Friendly Fraud

Customers falsely claim they didn’t authorize or receive a product.

- Refund Fraud

Scammers take advantage of return policies to get money back and keep the product.

- Triangulation Fraud

A scammer serves as a fake middleman between a retailer and a real buyer whose stolen payment information is used.

What Tools Can I Use to Detect and Prevent Online Fraud?

Prevention is the best defense. In 2025, AI-powered tools will analyze thousands of data points per transaction to detect risk in real time.

Key Features to Look for in a Fraud Detection Tool

- Machine Learning Risk Scoring

- Behavioral Biometrics – mouse movement, typing patterns

- IP & Geolocation Analysis

- Device Fingerprinting

- Monitoring repeated use of the same card/address

- Blacklist and Whitelist Management

Ways to Protect Your Business From Chargeback Fraud

While it’s hard to remove the risk of chargebacks completely, lowering them saves money for the company and safeguards its reputation. Here are some strategies to lessen the number of chargebacks your business experiences.

- An easy-to-understand return and refund policy

Many customers reach out to the credit card issuer directly since they find it easier to file a chargeback. Laying out a simple return policy shows the consumer that it’s easier and beneficial to contact the merchant first.

- Provide detailed product descriptions

Maintain transparency with the consumers as much as possible. Ensure customers understand what to expect from the product they are purchasing. Doing so not only avoids chargebacks but also improves the brand’s image.

- Easy access to the company’s contact information

If customers find it difficult to contact your customer service personnel, they may file a chargeback. Let customers know if 24/7 support is available or the time frame in which they can contact you. Return all client messages as soon as possible to resolve any issues in-house.

- Maintain a precise payment descriptor

Make sure all product descriptions on receipts include the name of the product or service and are clear and easy to comprehend. Clients should see the store name, the transaction date, and the amount on their credit card bills. Keep your particular records in addition to explicit billing descriptors. Keeping meticulous records might help later when required to defend a chargeback

- Investigate the chargeback occurrences

Take the time to investigate and analyze any chargebacks that may have occurred. Every person in your firm should know the payment regulations and follow them for each transaction. Above all, be cautious of any purchases made with credit cards that appear to be suspicious. Investigate the charge and validate its legitimacy before processing the payment.

Final Thoughts: Take Charge of Your Payments in 2025

In an era where fraudsters are sophisticated and consumers are more aware of their rights, chargebacks and payment fraud can quickly spiral out of control if left unchecked.

Your Game Plan for Protection

- Understand why chargebacks happen and how to prevent them.

- Be ready to fight back with evidence and tools.

- Invest in chargeback insurance for peace of mind.

- Use smart, AI-powered fraud detection software.

- Regularly train your team and audit your payment systems.

By staying informed and proactive, you don’t just reduce risk—you improve customer trust, approval rates, and profitability.

Ready to minimize fraud and win more chargebacks?

Explore how RapidCents can help you automate protection, recover losses, and secure your transactions, all from one powerful dashboard.