PCI compliance is more than just paperwork; it is your first line of defense against a fine and a data breach. But too many companies still get it wrong, not because they’re forgetful, but because compliance errors can appear harmless at first.

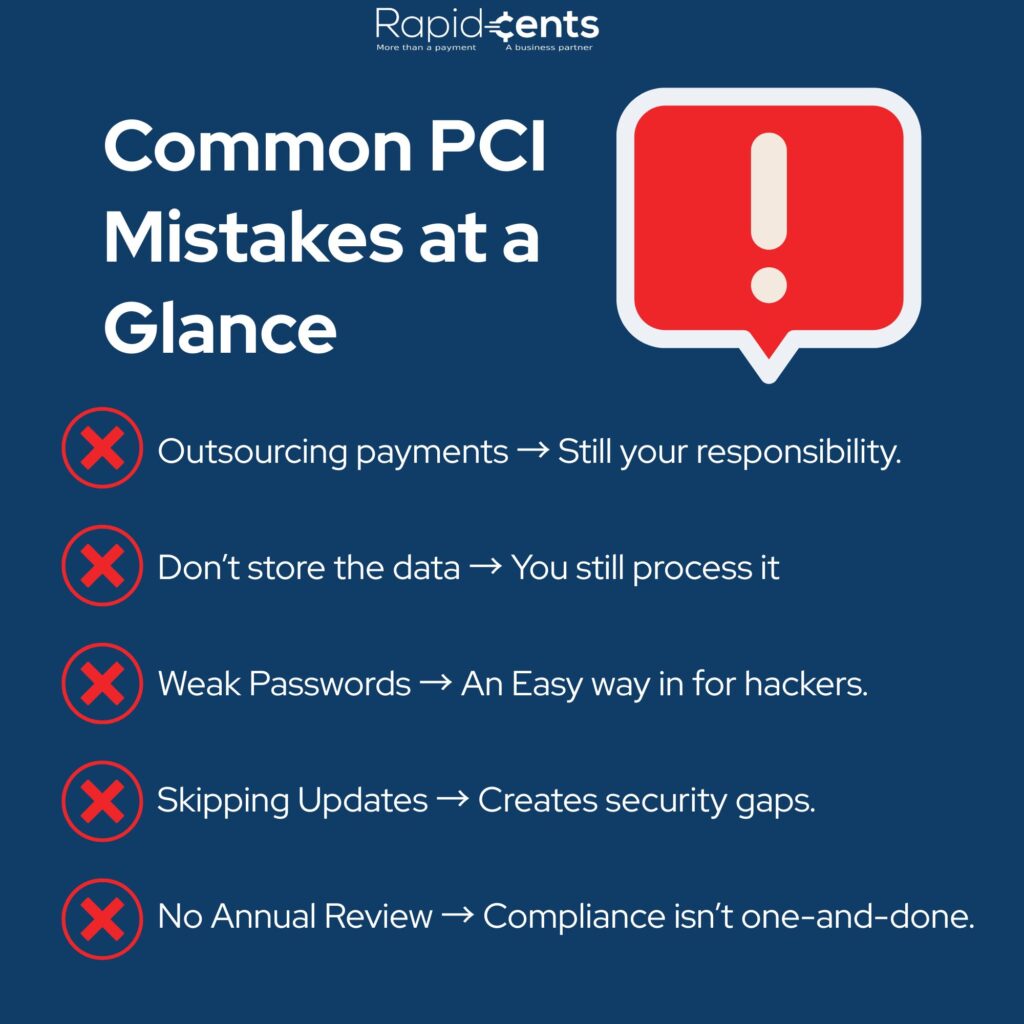

You might feel that outsourcing payments takes care of everything. Perhaps you think the fact that card data is not stored makes you safe. The reality? Small oversights create big vulnerabilities.

This guide breaks down the most common PCI mistakes, so you can avoid them before they cost you. Stay secure, stay compliant, and don’t let preventable errors put your business at risk.

- Assuming Outsourcing Equals Full Compliance

Many businesses believe that, by using a third-party processor, they are fully covered with PCI compliance. But even in the case of outsourced payments, you still have duties. You need to fill out the right SAQ, lock down your website and payment forms, and ensure that all service providers you work with are PCI compliant. If you skip those steps, you can still leave yourself open to breaches and fines. - Thinking “I Don’t Store Card Data, So I’m Safe”

Not retaining data doesn’t get you off the hook. If you store or transmit cardholder data, even if only briefly, you can’t escape compliance with the PCI DSS. Hackers frequently target data in transit, so you’ll want secure connections and encryption, as well as safe data handling practices to protect your business and your customers. - Using Weak Passwords or Shared Logins

Weak or compromised passwords are still one of the most straightforward methods for attackers to break into protected systems. Each user is supposed to have its own login with roles and permissions. Don’t use default passwords, ensure strong credentials, and use multi-factor authentication (MFA) to protect against unauthorized access to payment environments. - Skipping Regular Updates and Patches

Old software becomes a prime target for hackers. It often causes breaches because the businesses haven’t updated their point-of-sale systems, websites, or security software. Frequent updates and patches seal known security holes. When it comes to minimizing risk and remaining compliant, ensure your payment platform and plugins, along with the associated systems, are up to date. - Failing to Reassess Annually

And PCI compliance is not a one-and-done effort; it’s annual work. You have to fill out the SAQ and keep your own security updated. If your business changes, like adopting new payment tools or software integrations, your compliance strategy may need to do the same. By skipping the annual once-over, you’re headed for possible noncompliance and its penalties.

Tips for Simplifying PCI Compliance

- Use a PCI Compliant Payment Provider

A PCI-compliant processor helps you carry out safe transactions. It also offers solutions to keep sensitive card data out of your system. This way, you are not exposed to all the inherent risks and validation needs. - Tokenization to Reduce Exposure

Tokenization swaps card numbers for random tokens, so you don’t have to store real card data. This lowers your risk and makes PCI compliance easier. - Outsource Payment Data Handling

Think about using hosted checkout pages or payment gateways that manage the card entry and storage for you. This process tasks you with much less compliance while maintaining security.

Final Thoughts

PCI compliance isn’t simply about avoiding penalties, but a matter of trust. When customers give you their card details, they’re placing their trust in you to look after them.

The good news? Most PCI mistakes are preventable. With the right tools, transparent processes, and a payment partner that emphasizes security, compliance gets a whole lot easier and a lot less nerve-wracking.

RapidCents also powers merchants to reduce their PCI scope, provide a secure purchasing environment, and remain up to date with changing standards, so you can worry less about penalties and breaches and get on with running your business.

Want to know more about compliance?

Or Read More