If you take payment by credit or debit card, being compliant with PCI standards is not a choice; it’s a necessity. The Payment Card Industry Data Security Standard (PCI DSS) was created to safeguard credit card information and guarantee safe transactions for consumers.

Whether you are a new start-up or a well-established retailer in Canada, this guide will detail how you can become PCI compliant for your retail store, simplify the process, and avoid costly penalties.

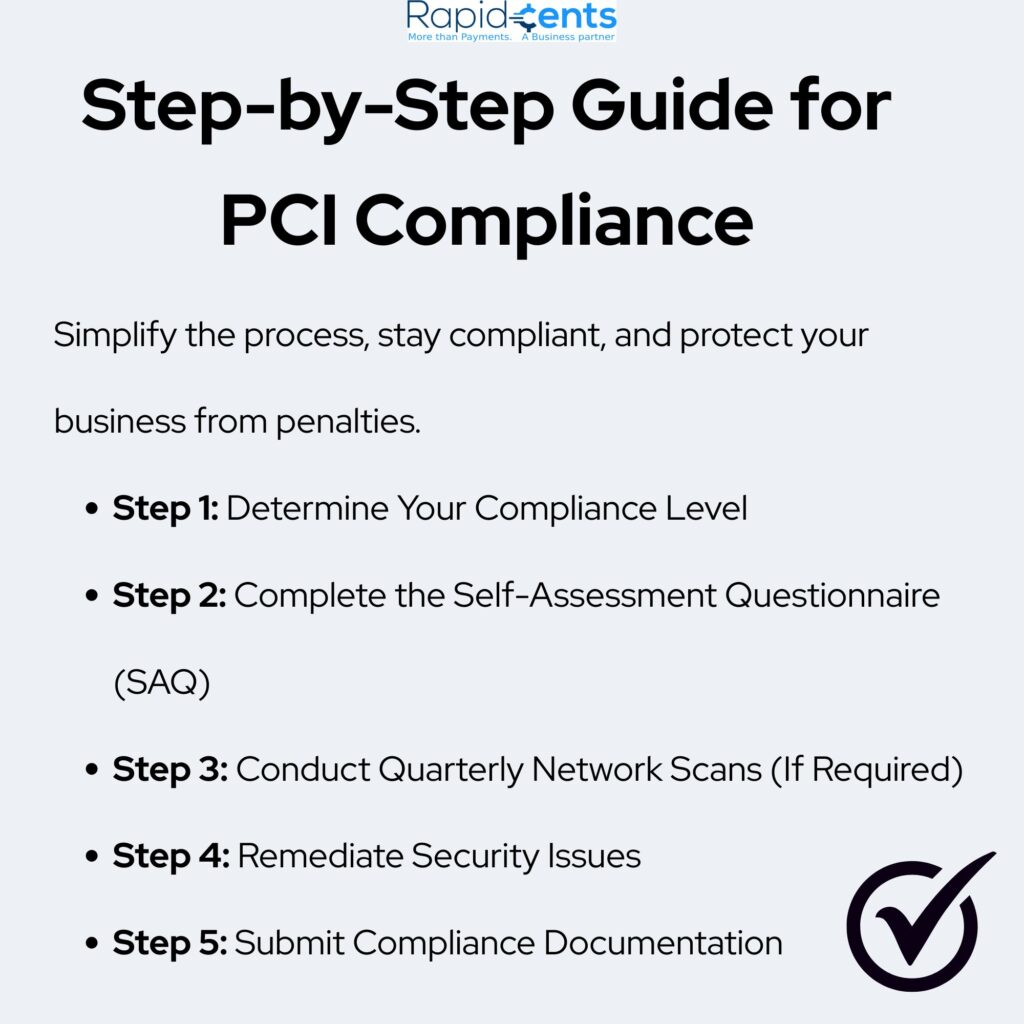

Step 1: Determine Your Compliance Level

The first thing you need to do is find out what merchant level you are, which is determined by the number of transactions you process each year and how you process transactions. The PCI DSS defines four merchant levels, with the largest volumes being Level 1, down to Level 4 with the smallest volumes.

After you have determined your level, you will be able to complete the correct Self-Assessment Questionnaire (SAQ). There are different versions of SAQ available, with each version being suited for merchants in different payment environments:

- SAQ A: For a completely outsourced eCommerce implementation (none of the card-data storage or processing is done by your systems)

- SAQ B: For transactions with a physical card at a stand-alone terminal

- SAQ C: POS systems that connect directly to the internet

- SAQ D: For those environments with more complexity (full PCI controls required)

Tip: Using a gateway such as RapidCents can lower your PCI burden and simplify your SAQ requirements.

Step 2: Complete the Self-Assessment Questionnaire (SAQ)

The SAQ is a list of security requirements your business must follow. It covers areas like:

- How you handle cardholder data

- Network security controls

- Employee access policies

The SAQ is completed every twelve months by the majority of small and mid-size businesses in Canada.

Step 3: Conduct Quarterly Network Scans (If Required)

If your business holds, processes, or transmits cardholder data through internet-based systems, you’ll have to do quarterly scans for vulnerabilities.

A PCI SSC-approved scanning Vendor should do these scans.

The scan reveals any security vulnerabilities an attacker might exploit.

Step 4: Remediate Security Issues

If the SAQ or network scan finds any vulnerabilities, you will need to remedy the issues before going on. This may involve:

- Updating software

- Reconfiguring network settings

- Implementing stronger password policies

- Patching security flaws

Addressing these problems diminishes your chances of being breached.

Step 5: Submit Compliance Documentation

After you finish the SAQ, resolve any issues, and meet any scanning requirements, you can proceed with submitting documentation to your:

- Acquiring bank

- Payment processor

They can ask for evidence of satisfactory compliance each year, particularly if you operate online or point-of-sale (POS) systems.

Resources for Canadian Merchants

To help guide you through PCI compliance, turn to these reliable resources:

- PCI Security Standards Council

https://www.pcisecuritystandards.org - Canadian Centre for Cyber Security (CCCS)

https://cyber.gc.ca - RapidCents Support

Get guidance, tools, and compliant payment solutions to help with PCI compliance.

Contact Us

Need Help? Contact RapidCents Today

PCI compliance could seem daunting, but it doesn’t have to be.

RapidCents delivers Canadian merchants easy, secure, and PCI-compliant payment solutions without the compliance headaches. We work with you from secure payment gateways to tokenization, and hosted checkout:

- Reduce your PCI-related risks

- Protect your business from breaches

- Maintain customer trust

Contact RapidCents now and start using a hassle-free shortcut to PCI.