There are 29,955 FinTech providers available worldwide. That ranges from the smallest startups to financial titans like J.P. Morgan. It means that merchants have more payment options than they can handle. More choice is generally better because it brings competition and better pricing, but in payments, it can end up translating into confusing complexity.

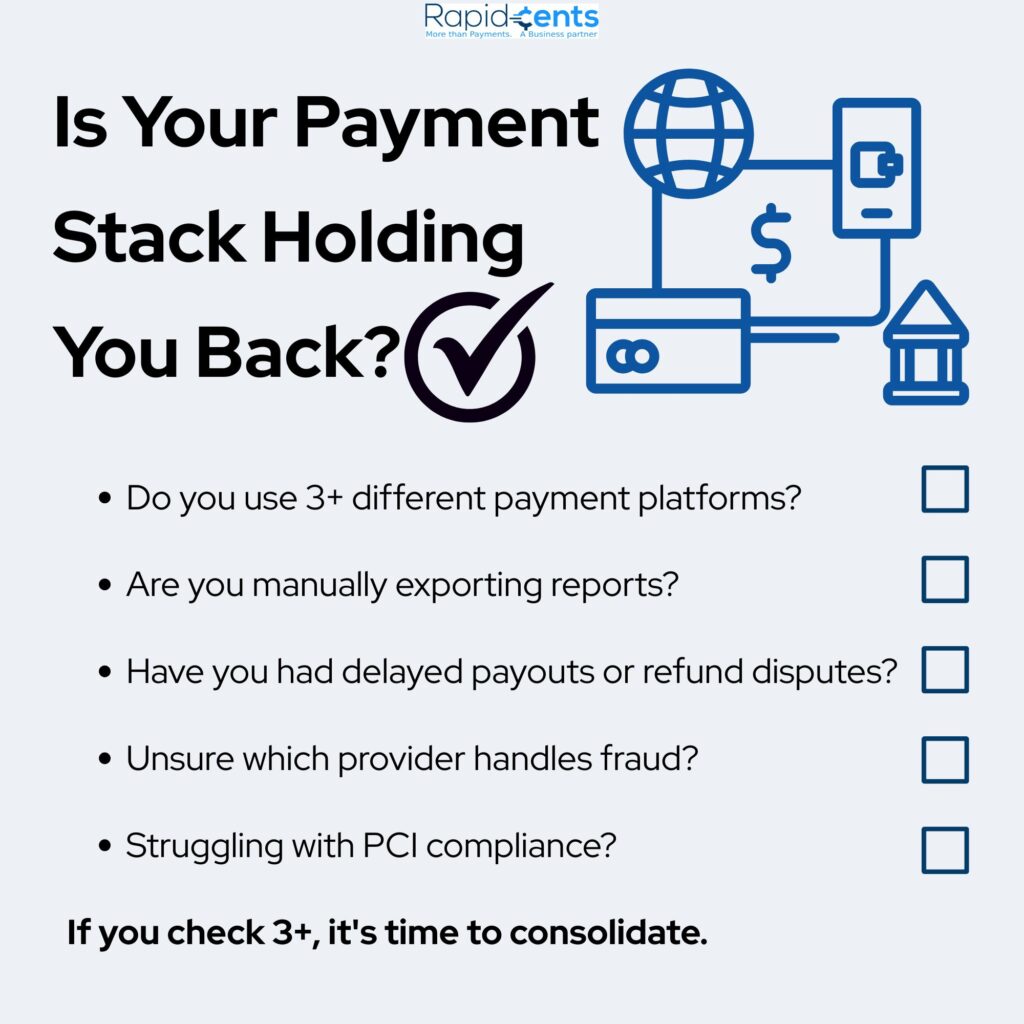

Being a business owner, these decisions can be so overwhelming. Should you choose one platform for checkout and another for recurring billing? Do you want a separate supplier for fraud detection or reporting? It’s tempting to mix and match based on rates or features, but doing so can come with hidden risks.

Here’s a clear breakdown of how too many payment tools can hurt your operations, and what you can do to keep things simple, secure, and scalable.

1. Disconnected Systems Slow You Down

When your checkout, invoicing, reporting, and customer data are scattered across different systems, it generates extra work. Systems may not sync, data gets siloed, and teams have to manually patch gaps.

- Why it matters: Manual work leads to mistakes. Payment errors, missed invoices, or incomplete records can frustrate customers and waste time.

- What to do: Use tools that integrate or choose a provider that offers an all-in-one solution. Integration should be simple and seamless.

2. Higher Costs Across Multiple Providers

Working with multiple vendors may seem like a cost-effective strategy. But each processor has a setup fee, processing costs, monthly minimums, or API fees.

- Why it matters: Paying multiple vendors can lead to higher overall costs than using a single platform.

- What to do: Ask each provider for an itemized list of costs. Don’t just focus on per-transaction fees; compare total cost of ownership.

3. Numerous Compliance and Security Risks

All payment processing companies must follow standards related to data privacy, anti-money laundering (AML), and PCI DSS. Compliance is also becoming stricter, such as the EU’s MiCA and India’s RBI framework.

- Why it matters: Your business could face fines or penalties if even one partner fails to meet compliance.

- What to do: Always check whether a payment processor is compliant or not. Select partners with updated certifications and clear policies.

4. Customer Experience Becomes Inconsistent

Customers don’t care how many providers you’re using behind the scenes. They just want a fast, smooth, and familiar checkout experience.

- Why it matters: Customers will abandon the cart if there are multiple redirects, poor page design, or limited payment options.

- What to do: Choose processors that offer branded, customizable, and seamless payments.

5. Support Gets Complicated

When a payment fails or a refund is delayed, it can be hard to know which provider is responsible. You may end up contacting multiple support teams just to fix one issue.

- Why it matters: Slow response and support issues damage your reputation and raise internal stress levels.

- What to do: Work with providers who offer centralized support across all services, or at least provide a clear point of contact.

Final Thought: Simplify for Success

Having choices is great. But when it comes to payment processing, too many disconnected tools can do more harm than good. From technical glitches to added expense and compliance risks, fragmentation can slow your business down.

Instead of running around with several systems bouncing off your head, look for one or two strong partners that can scale with you. The objective isn’t to leverage every tool, but to build a tech stack that helps you run a clean, efficient payment process that keeps your customers coming back for more.

Review your current payment setup. Do you fix things more than you help your customers? If that is the case, it may be time for simplification. Less friction results in quicker payments, less stress, and better growth opportunities.

How RapidCents Can Help

At RapidCents, we know how tough it can be to juggle several types of payment technology. That’s why we created our all-in-one payment processing solution to help you take the complexity out of your business.

No hidden fees. No fragmented support. Only one partner who makes your business run smarter, grow faster, and please your customers more.

Need help tidying up your payment stack? Let’s talk.

Or you can review our solutions