E-commerce, which is expanding rapidly, is reshaping how people shop and pay for goods online across North America. According to a MarketLine Report, the credit card market is expected to continue growing drastically. These are market trends that merchants will have to know to remain competitive.

Why Credit Cards Matter More Than Ever

Shopping online has also reshaped how consumers pay, leading more people to digital payment methods like credit cards. According to a Capital One Shopping report, there were over 150 million credit card transactions per day in the US in 2024. And these numbers are projected to increase with each passing year.

People use credit cards online for the convenience, speed of payment, and security. Yet enhancements in mobile payments and digital wallets make credit cards even more valuable for online shopping.

Top Trends That Will Change E-commerce Payments

1. Better Security and Less Fraud

Security will remain a priority. Merchants will benefit from security enhancements, such as fingerprint or facial recognition, secure payment tokens, and AI-fueled fraud prevention. If you invest in a robust authentication solution, it saves you money by protecting your customers and mitigating chargebacks.

2. Contactless and Mobile Payments Will Take Over

In the wake of the pandemic, more consumers are opting for contactless payments with digital wallets like Apple Pay or Google Pay. Traders with simple phone-based payment options will shorten transactions and improve customer satisfaction.

3. Flexible Payment Options Become Common

There are now more people using Buy Now, Pay Later (BNPL) products. There should also be flexible installment options from credit card companies by 2028. Merchants who offer these payment options could receive larger orders and more sales.

4. Personalized Rewards and Customer Experiences

Credit card companies will leverage AI and data to provide consumers with targeted rewards and offers. Retailers may also use this as a basis to encourage customer loyalty and engagement for subsequent sales through rewards schemes.

Emerging Challenges for Merchants

As the use of credit cards becomes more common, so do the challenges that merchants face.

- Higher Transaction Costs: The more people pay with cards, the more merchants have to pay in processing fees. Businesses need to ensure good terms and manage these costs closely.

- Complicated Regulations: Stricter regulations for data privacy and security will make it more difficult for merchants to maintain compliance and transparency.

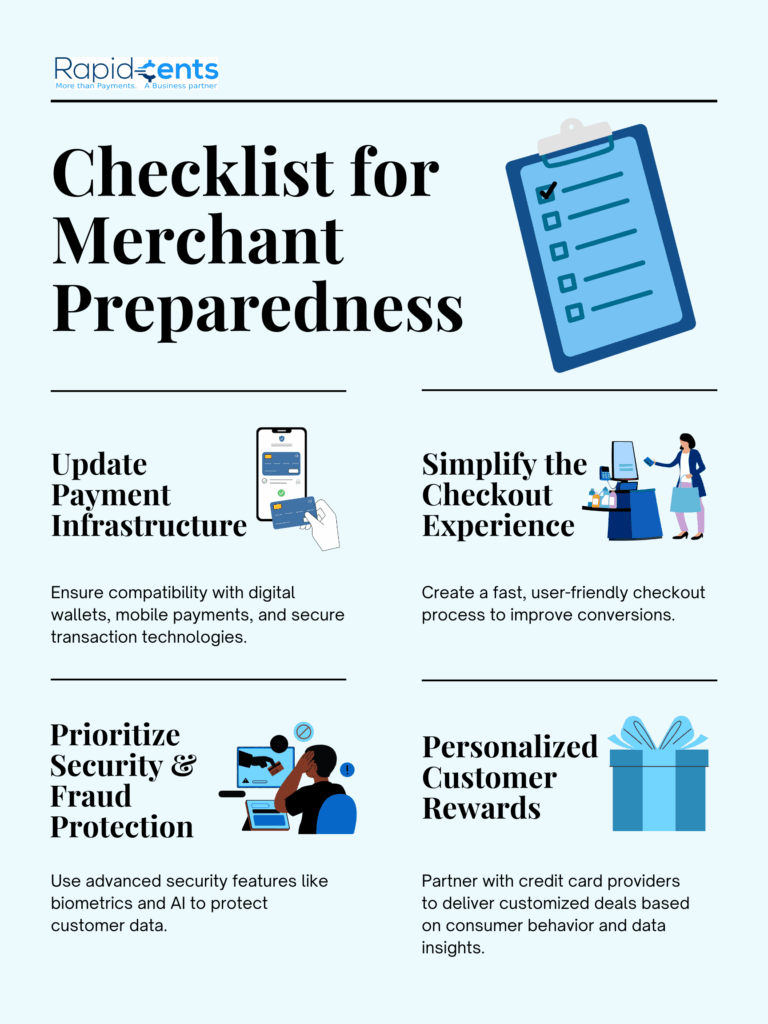

How Merchants Can Prepare for These Challenges

Here are some simple things merchants can do to capitalize on these trends:

- Update Payment Systems: Make sure payment systems are secure, mobile-friendly, and can accept many payment types.

- Improve Options: Simplify the checkout process and offer different ways to pay according to the customer’s needs.

- Safety and Security: Use cutting-edge tools against payment fraud and to keep customer data safe.

- Personalized Experiences: Work with payment gateways that are able to design rewards and promotions with the customer’s data.

Stay Ahead with RapidCents

With e-commerce on the rise, companies require secure, flexible payment solutions that are also easy to scale. Payment technology has evolved a lot in recent years, and RapidCents offers merchants the tools they need to adapt to these changes, complete transactions, and keep customers smiling.

Those merchants who recognize and react to these trends will fare better in the increasingly digital marketplace of 2028.

[Source: https://www.marketline.com/: Credit Cards in North America, November 2024]